The most competitive housing market ever is finally showing signs of breaking.

As data trickles in for April, it’s becoming clear that the historically hot housing market has flipped trajectories. It’s now in cooling mode. The number of homes listed for sale is rising again. Fewer shoppers are scheduling tours. And Redfin reports 15% of home sellers in April cut their asking price—up from 9% a year ago.

The red-hot housing market’s days are numbered. While I don’t anticipate a collapse á la the Great Recession, rising mortgage rates and inventory are sure to cool what has been an unprecedented time for the U.S. housing market,” says Ralph McLaughlin, chief economist at Kukun, a real estate data and analytics company.

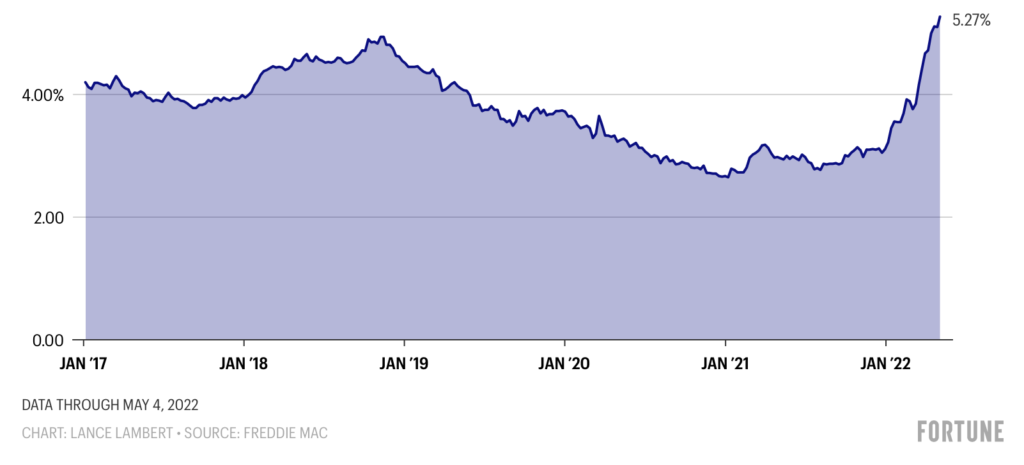

This softening is by design. The Federal Reserve is done watching inflation run away, and has made it a priority to cool down one of its biggest drivers: the housing market. To do so, over the past few months, the Fed has put upward pressure on mortgage rates. In December, the average 30-year fixed mortgage rate sat at 3.11%. As of last week, that rate is up to 5.27%—its highest level since 2009.

As mortgage rates rise, of course, it puts downward pressure on the housing market. If someone took out a $500,000 mortgage at a 3.11% fixed rate, that borrower would owe a monthly principal and interest payment of $2,138 on a 30-year loan. However, at a 5.27% rate, that payment would jump to $2,767. Not only are those higher rates pricing out some would-be homebuyers, but it also means some borrowers—who must meet lenders’ strict debt-to-income ratios—have lost their mortgage eligibility.

Homebuyers continue to be squeezed in nearly every way possible, which is causing some to take a step back from the market,” wrote Daryl Fairweather, chief economist of Redfin, in a report published last week.

Mortgage rates are spiking

Average 30-year fixed mortgage rate

The softening we’ve seen so far is fairly mild. However, industry insiders tell Fortune the cooling over the past few weeks is just the start. The lack of inventory over the past two years has created a pileup of would-be buyers. Even as rates price out some of those buyers, there are others waiting to take their place. Housing economists say it will take time to work through that pent-up demand. But once we do, the housing market could cool even further.

We know the system is logjammed, but we don’t know how far back the logjam goes…In my opinion, it will take a couple months for all this to shake out,” Devyn Bachman, vice president of research at John Burns Real Estate Consulting, tells Fortune.

As the housing market works through that logjam, home prices in the short term might continue pushing upward. According to Redfin’s Fairweather, that’s exactly what we’re still seeing. “Even though price drops are becoming more common, most homes are still selling above asking price and in record time,” she writes.

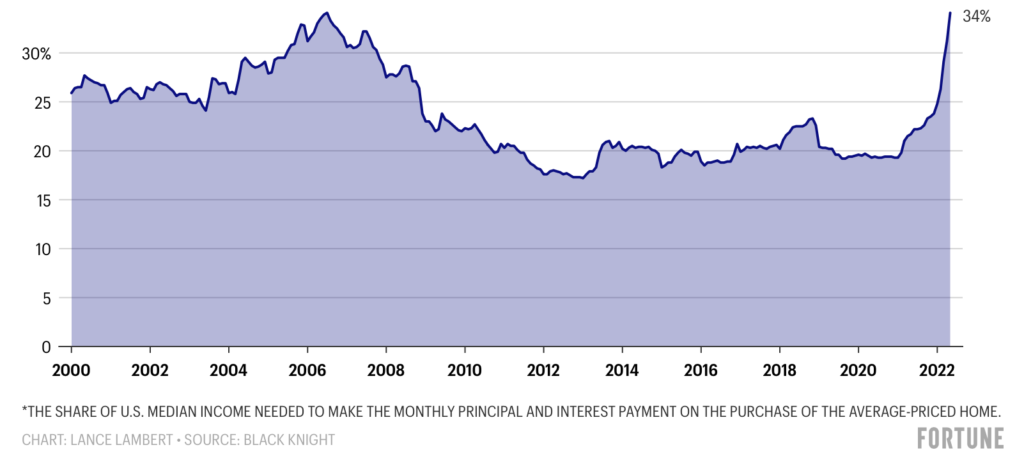

Mortgage payment-to-income ratio

The economic shock caused by spiking mortgage rates also increases the odds the housing market could overheat or even move into a price correction.

During much of the pandemic’s housing boom, historically low mortgages shielded homebuyers, to a degree, even as home prices shot up 34.4% over the past two years. Now, with mortgage rates back up, buyers have no choice but to feel the full brunt of home price growth. In December, the typical American household would have to spend 24% of its monthly income to make a mortgage payment on the average-priced U.S. home, according to Black Knight, a mortgage technology and data provider. As of last week, Black Knight’s mortgage-payment-to-income ratio is now up to 34%. That reading, which is the highest since 2006, is giving some economists housing bubble déjà vu.

Mark Zandi, chief economist of Moody’s Analytics, tells Fortune that spiking mortgage rates should cause year-over-year home price growth—which is up 19.8% over the past 12 months—to slow to zero by this time next year. If it comes to fruition, it would mark the slowest home price growth rate since April 2011 to April 2012.

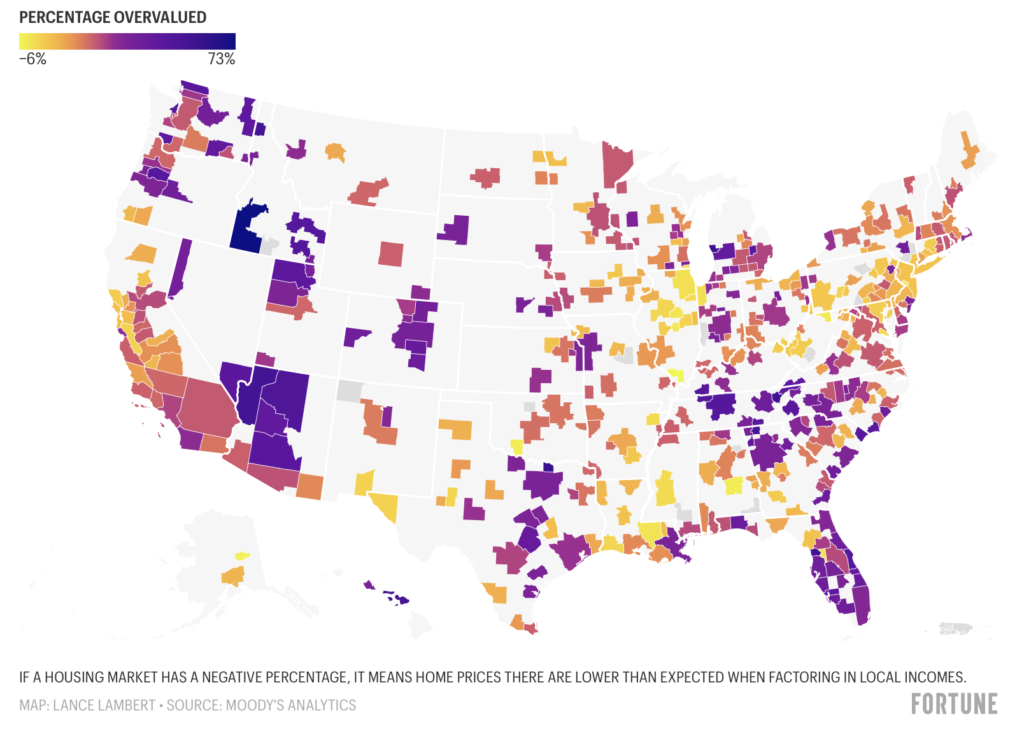

That said, Zandi expects some of the nation’s most overpriced regional housing markets to overheat and see price drops between 5% to 10% over the coming year.

How much regional home prices are “overvalued” by

Not everyone agrees with Zandi that home price growth is about to flatline. Over the coming 12 months, CoreLogic predicts U.S. home prices are set to rise another 5.9%. Meanwhile, the Mortgage Bankers Association forecasts that U.S. home prices will rise 5.2% over the coming 12 months. While those outlooks aren’t as bearish as Zandi’s prediction, they do all agree that price growth is set to decelerate significantly. Simply put: Forecasters think the ongoing housing boom is winding down.

We are at an inflection point for the housing market,” says Ali Wolf, chief economist at Zonda, a housing market research firm. “There are early signs of some of the fundamentals weakening, such as an increase in homes with price cuts, a rise in cancellations at new-home communities, and more loan officers reporting buyers are starting to stretch.”

Article source AND to view the interactive maps/data: https://fortune.com/2022/05/11/housing-market-home-prices-something-is-happening-mortgage-rates/.

Leave a Reply